In the world of crypto, sudden market crashes can be financially daunting. Fortunately, AI trading bots offer a way to help protect your investments, using smart algorithms that monitor, adjust, and hedge your assets to reduce losses when prices drop. Here are five AI trading bots designed to help you ride out the storms in crypto markets and keep your investments safer during downturns.

1. ValueZone AI

Overview: ★★★★★ 5/5

ValueZone AI excels in providing real-time risk management tools to guard against market crashes. Its AI algorithms are designed to detect downturns quickly, adjusting your positions to shield your investments from significant losses. Plus, with customizable settings, ValueZone AI allows you to align the bot’s trading style with your own risk tolerance, making it ideal for both beginners and seasoned traders looking for strong market protection.

Why It’s Great for Market Crashes:

- Real-Time Monitoring: ValueZone AI reacts quickly, shifting your portfolio into more stable assets like USDT or stablecoins when volatility.

- Customizable Risk Settings: You can set your risk tolerance and automatically adjust your investments based on your comfort level.

- Stop-Loss and Take-Profit: The bot has built-in stop-loss and take-profit features, it automatically closes, reducing the risk of major losses during market crashes.

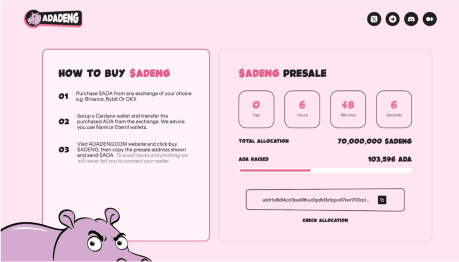

How to Sign Up for ValueZone

ValueZone AI makes it easy to protect your investments with AI bots. Here’s how you can get started:

- Visit the Website:

Go to the ValueZone AI website and click on the “Sign Up” button. - Create an Account:

Register using your email and create a secure password. Confirm your email to activate your account. - Claim Your $50 Free Bonus:

New users can claim a $50 free bonus, allowing you to test the AI bots risk-free.

- Affiliate 3.5% Referral Program:

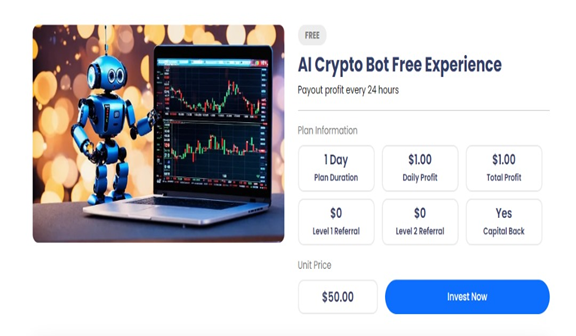

Invite friends to join ValueZone AI, and earn a 3.5% referral bonus on their trading fees. - Free Experience of Trading Bot Trials:

Try out different AI bot strategies with free trial plans, so you can find the right one for your trading goals. - Choose Your Plan:

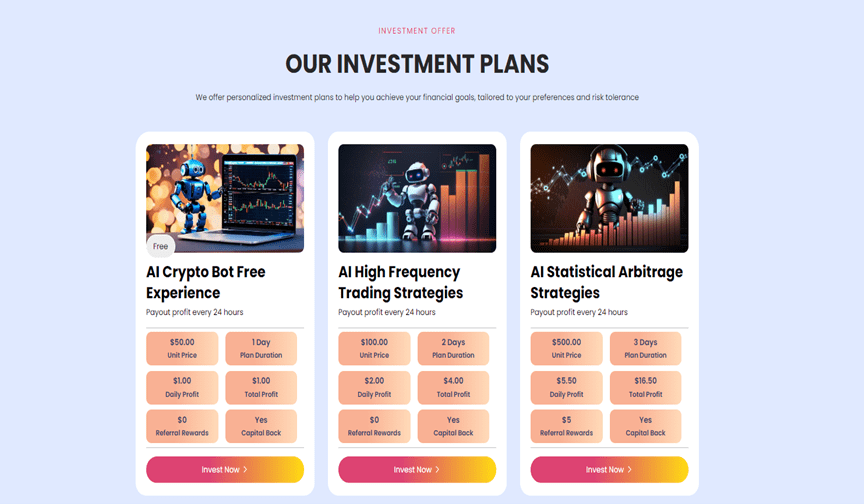

Pick a plan that fits your needs, from the AI Crypto Bot Free Experience to advanced strategies designed to protect your investments in bear markets.

- AI High-Frequency Trading Strategies: Invest $100 for 2 days and earn $4 daily.

- AI Statistical Arbitrage Strategies: Invest $500 for 3 days and earn $5.50 daily.

- AI Cross Market Arbitrage Strategy: Invest $1500 for 7 days and earn $18 daily.

- AI Short-Term CTA Strategy: Invest $3000 for 10 days and earn $39 daily.

- AI Short-Term Alpha Strategy: Invest $5000 for 15 days and earn $70 daily.

- AI Trend Following Strategy: Invest $8000 for 15 days and earn $120 daily.

- AI Quantitative Hedging Strategy: Invest $15,000 for 25 days and earn $240 daily.

- AI Dynamic Portfolio Strategy: Invest $23,000 for 25 days and earn $391 daily.

- AI Capital Weighted Portfolio Strategy: Invest $35,000 for 30 days, earn $630 daily.

- AI Momentum Investment Strategy: Invest $50,000 for 30 days and earn $950 daily.

- AI Growth Investment Strategy: Invest $100,000 for 45 days and earn $2000 daily.

2. 3Commas

Overview: ★★★★☆ ⅘

Overview: 3Commas is a versatile trading bot that helps you manage crypto investments with automation. While it is suitable for various strategies, it excels at risk management, making it a great option during volatile market conditions.

Why It’s Great for Market Crashes:

- Smart Trade Features: With 3Commas, you can set a stop-loss, take-profit, and trailing stop orders that help mitigate losses during a market crash.

- Dollar-Cost Averaging (DCA): This strategy is beneficial in a market crash, as it allows the bot to buy assets in smaller amounts over time, reducing the impact of sudden price drops.

- Risk Management Tools: The bot can monitor your portfolio’s performance and automatically adjust based on pre-set risk parameters, helping to protect you when market conditions worsen.

3. Pionex

Overview: ★★★★☆ 4/5

Pionex is a low-fee exchange that comes with a suite of powerful trading bots. It’s popular for its ease of use and automated trading features, which are ideal for those looking to protect their portfolios during volatile periods.

Why It’s Great for Market Crashes:

- Grid Trading Bot: The Bot automatically buys and sells based on pre-set intervals, making it an effective strategy during market downturns. It locks in profits when prices are dropping and can help prevent large losses.

- Smart Stop-Loss: Pionex ensures that your trades are automatically sold when the market moves against you. This is particularly helpful in preventing larger losses during a market crash.

- Low Fees: During market crashes, trading fees can quickly add up.

4. Cryptohopper

Overview: ★★★★☆ 4/5

Cryptohopper’s trailing stop-loss feature is particularly useful for hedging during a downturn. This feature allows you to protect your gains by automatically adjusting sell orders based on price movements, helping to lock in profits even as the market declines. Cryptohopper also offers a wide range of technical indicators, making it suitable for both simple and advanced strategies.

Why It’s Great for Market Crashes:

- Sell-Down Strategies: Cryptohopper offers sell-down strategies, where the bot automatically liquidates your positions to avoid further losses when the market is crashing.

- Rebalancing: The bot can automatically rebalance your portfolio, shifting your funds into less volatile assets or stablecoins as the market declines.

- Trailing Stop-Loss: Cryptohopper offers trailing stop-loss, which allows the bot to lock in profits by selling assets if their price starts falling significantly after reaching a certain peak.

5. Bitsgap

Overview: ★★★★☆ 4/5

Bitsgap combines automated trading with arbitrage opportunities, helping you find and execute trades across multiple exchanges. Its arbitrage bot is particularly valuable during down markets, as it identifies low-risk trading opportunities across different platforms. This approach allows you to hedge your crypto assets while exploring various trading options.

Why It’s Great for Market Crashes:

- Arbitrage Trading: During a market crash, prices may vary across different exchanges. Bitsgap’s arbitrage bot helps you take advantage of these price differences, even in volatile market conditions.

- Stop-Loss and Take-Profit: Bitsgap allows you to set automated stop-loss and take-profit orders, ensuring that your assets are sold at preset prices, protecting you from further losses during a crash.

- Portfolio Management: Bitsgap lets you track and manage your crypto portfolio automatically, ensuring that you can reallocate funds away from risky assets and into safer options as market conditions worsen.

Conclusion

Using AI trading bots can provide a safety net during market downturns by automating strategies that hedge against losses. Each bot in this list brings something unique to the table. ValueZone AI stands out as a top pick for its highly adaptive risk management, strong customization options, and affordability, making it a versatile and reliable choice for those looking to protect their assets. When the market becomes unpredictable, these AI bots offer a valuable toolset to help you navigate challenging conditions and keep your investments safer.

Disclaimer: This is a paid release. The statements, views and opinions expressed in this column are solely those of the content provider and do not necessarily represent those of NewsBTC. NewsBTC does not guarantee the accuracy or timeliness of information available in such content. Do your research and invest at your own risk.